The Flawed Narrative: Analyzing the Hindenburg Report on SEBI and Adani

The recent report by Hindenburg Research, titled “Whistleblower Documents Reveal SEBI’s Chairperson Had Stake In Obscure Offshore Entities Used In Adani Money Siphoning Scandal,” is yet another sensational piece designed to create panic and stir controversy without substantial evidence. The report, which claims to expose deep-rooted corruption involving SEBI Chairperson Madhabi Buch and the Adani Group, is riddled with contradictions, logical flaws, and unsupported assertions. Below, I dissect the key points made in the report and illustrate the numerous flaws inherent in its arguments.

Misleading Allegations Against SEBI

1. Lack of Substantive Evidence:

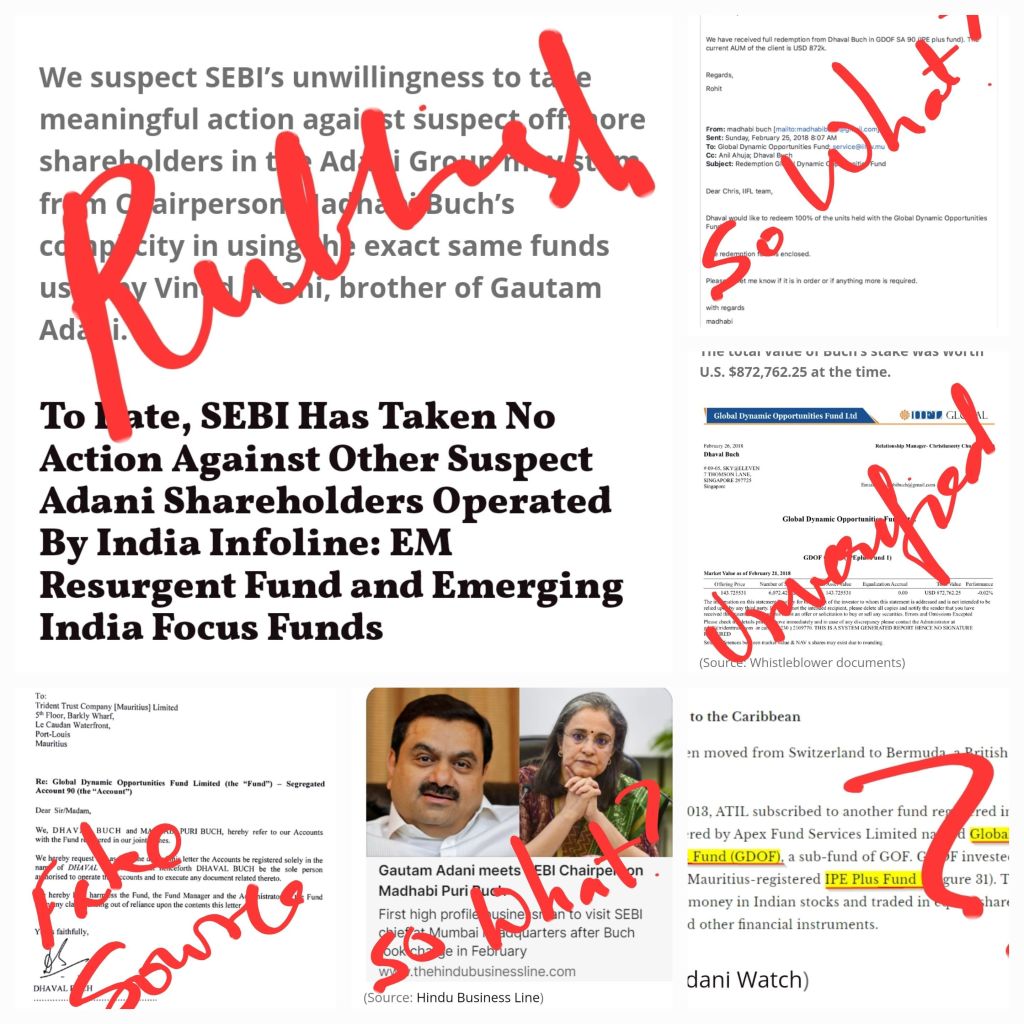

Hindenburg’s report heavily relies on unnamed whistleblowers and anonymous documents to make its case. The credibility of these sources is highly questionable, especially when the allegations are as severe as those presented. The report itself admits that the whistleblower documents could not be independently verified. This reliance on unverified documents renders the report speculative at best, undermining its claims of exposing factual wrongdoing.

2. Misinterpretation of SEBI’s Role:

The report criticizes SEBI for not taking “meaningful action” against the Adani Group, suggesting that this inaction is evidence of corruption. However, SEBI’s regulatory framework requires a thorough and evidence-based investigation before any punitive action can be taken. The absence of immediate public action does not imply a lack of investigation or collusion but rather adherence to due process. Moreover, the Indian Supreme Court’s observation that SEBI had “drawn a blank” in its investigation does not necessarily imply negligence; it could simply indicate the complexity of the case and the challenges inherent in untangling intricate financial structures.

3. Contradictory Claims Regarding Regulatory Oversight:

Hindenburg accuses SEBI of both failing to act against Adani and of excessively scrutinizing their own disclosures. This contradiction highlights a fundamental flaw in the report: it attempts to paint SEBI as both overly passive and overly aggressive in its regulatory duties, depending on what suits the narrative. The reality is that SEBI’s actions are consistent with its mandate to maintain market integrity, whether that involves scrutinizing external reports like Hindenburg’s or investigating complex corporate structures.

Baseless Accusations Against Madhabi Buch

1. Questionable Timing and Relevance:

The report’s focus on Madhabi Buch’s alleged offshore investments seems to be an attempt to distract from the broader context. The transactions mentioned took place years before her appointment as SEBI Chairperson, and the report fails to demonstrate any direct connection between these investments and her regulatory decisions. The suggestion that Buch’s personal investments influenced SEBI’s handling of the Adani case is speculative and unsubstantiated.

2. Conflict of Interest Misrepresented:

The report implies that Buch’s past investments constitute a conflict of interest in her role at SEBI. However, the transactions described are not illegal, nor do they necessarily indicate any wrongdoing. The transfer of shares to her husband prior to her appointment as SEBI Chairperson is portrayed as suspicious, but such actions are common in situations where individuals take on public roles and seek to avoid even the appearance of a conflict of interest. Hindenburg’s failure to provide concrete evidence of any improper influence stemming from these investments weakens its case.

Overstating Adani’s Influence

1. Misleading Interpretation of Corporate Structures:

Hindenburg paints a picture of a vast, hidden network of offshore entities controlled by the Adani family, designed to siphon money out of India. While complex corporate structures are often used in international business, their existence alone does not imply illegal activity. The report fails to acknowledge that many large multinational corporations use similar structures for legitimate purposes, such as tax efficiency and regulatory compliance. The mere existence of these structures does not prove any wrongdoing on Adani’s part.

2. Ignoring Broader Industry Practices:

The report singles out the Adani Group for practices that are common in the global business world, such as using offshore entities for investments. By focusing exclusively on Adani, Hindenburg ignores the fact that many other corporations engage in similar practices without facing allegations of impropriety. This selective reporting creates a distorted view of the situation and unjustly targets Adani without context.

3. Failing to Account for Adani’s Legal Victories:

The report conveniently omits mentioning that many of the allegations against Adani have been challenged and, in some cases, dismissed in legal settings. Adani Group has consistently defended itself against these accusations, and courts have often found in its favor. The omission of this critical information gives a one-sided view of the situation and suggests a bias in Hindenburg’s reporting.

Inconsistent Logic and Flawed Conclusions

1. The “Guilt by Association” Fallacy:

Hindenburg’s report repeatedly uses the guilt by association fallacy, implying that because Buch’s investments were associated with entities that had connections to Adani, she must be involved in wrongdoing. This is a flawed argument. Mere association does not equate to guilt, and the report fails to provide evidence that Buch’s investments had any influence on her regulatory decisions. The use of this fallacy further weakens the report’s credibility.

2. Overstating the Impact of Allegations:

The report suggests that SEBI’s actions, or lack thereof, regarding Adani have had a significant impact on the Indian market. However, it provides little evidence to support this claim. The Indian stock market remains one of the fastest-growing in the world, and investor confidence in regulatory bodies like SEBI has not significantly waned. The report’s attempt to exaggerate the impact of these allegations appears to be an effort to create panic rather than provide a balanced analysis.

3. Ignoring SEBI’s Broader Regulatory Successes:

While the report fixates on perceived failures in the Adani case, it ignores SEBI’s broader track record of regulatory successes. SEBI has played a crucial role in maintaining the stability and integrity of the Indian financial markets over the years, successfully regulating numerous complex cases. The omission of this context suggests a selective approach to reporting that undermines the report’s objectivity.

Conclusion: A Flawed and Misleading Report

Hindenburg Research’s report on SEBI and the Adani Group is a classic example of sensationalism over substance. The report relies on unverified sources, speculative arguments, and logical fallacies to paint a picture of widespread corruption without providing concrete evidence. By misinterpreting SEBI’s role, overstating the significance of Buch’s past investments, and selectively reporting on Adani’s business practices, Hindenburg has crafted a narrative that is more fiction than fact.

In the end, the report fails to make a convincing case against SEBI or the Adani Group. Its contradictions, lack of evidence, and logical flaws suggest that it should be taken with a heavy dose of skepticism. As with any complex financial matter, a thorough and objective investigation is necessary to uncover the truth, and Hindenburg’s report falls far short of this standard.

#AdaniGroup #SEBI #CorporateScandal #FinancialRegulation #FlawedReport #HindenburgResearch #OffshoreFunds #StockManipulation #CorporateFraud #IndianMarket #TruthUnveiled

Hello. Thanks for visiting. I’d love to hear your thoughts! What resonated with you in this piece? Drop a comment below and let’s start a conversation.